Buncombe County Manager Avril Pinder presented the FY2026 Recommended Budget to the Board of Commissioners on May 6, 2025, outlining a $435 million General Fund plan shaped by recovery from Tropical Storm Helene and a shifting economic landscape.

The proposal includes a 3.26-cent property tax increase, resulting in an estimated additional $114 annually for a home valued at $350,000. This adjustment is projected to generate $17.1 million in revenue required to achieve a balanced budget.

Key Budget Themes: Recovery, Responsibility, and Stability

The County continues to feel the financial and structural impacts of Tropical Storm Helene, which destroyed more than 300 residences, damaged hundreds of bridges, and left over 8,000 housing units in need of repair. In total, County staff contributed more than 180,000 hours to emergency response efforts, aided by support from 38 states.

Economic Landscape and Fiscal Challenges

While unemployment surged to nearly 11% in late 2024, it has improved to just over 5% as of March 2025. However, ongoing revenue pressures—including declines in sales and occupancy taxes—underscore the need for conservative financial planning. The FY2026 Recommended Budget includes:

- 1.5% decrease in operational expenditures

- No new positions, with only two reclassifications

- 3.09% cost-of-living adjustment (COLA) for employees

- No use of fund balance to support operations

- 55.02 cent property tax rate (up from 51.76 cents)

Education Investments

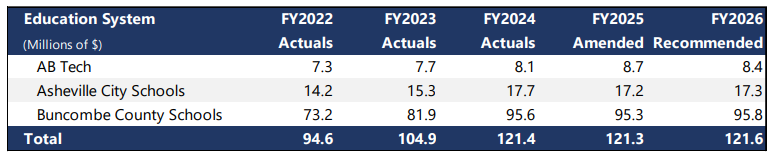

Education remains the County’s largest funding priority, with $121.8 million allocated—nearly 28% of total expenditures. Over the past four years, education funding has increased $23.5 million.

The FY2026 recommended education budgets are each reduced by the unrestricted revenue rate, which is down 3.49% from the FY2025 adopted budget:

- A-B Tech - $8.4 million, down from the FY2025 amended budget of $8.7 million

- Asheville City Schools - $17.3 million, up from the FY2025 amended budget of 17.2 million

- Buncombe County Schools - $95.8 million, up from the FY2025 amended budget of $95.3 million

?Continued Investments in Public Safety, Human Services, and More

Recommended General Fund budgets also include:

- Public Safety (including Sheriff’s Office, detention center, community paramedics, EMS, and more) - $99 million

- Human Services (including Medicaid, child support, aging & adult services, public health, veterans services, and more) - $97 million

- General Government (including elections, Register of Deeds, tax collection, information technology, and more) - $66 million

- Debt - $18 million

- Cultural and Recreational (including parks, libraries, and more) - $12 million

- Interfund Transfers - $9 million (including Early Childhood Education funding, Transportation, and Conservation Easements)

Planning for the Future

To support long-term sustainability, the County plans to use the upcoming 2026 property reappraisal to evaluate and potentially reset tax rates. While the projected FY2026 ending fund balance sits below the 15% policy threshold at 12.8%, the County is not drawing on reserves and is maintaining compliance with state financial regulations.

Other Funds

The recommended budget provides $624,058,019 in total expenditures across all operating funds. Other annual funds include:

- 911 Special Revenue Fund budget of $728,900

- Opioid Settlement Fund budget of $3,218,194

- Tax Reappraisal Reserve Fund budget of $703,280

- Solid Waste Enterprise Fund budget of $16,237,293

- Insurance and Benefits Fund budget of $48,242,165

Budget Timeline

- May 20: Public Hearing

- June 3: Final Budget Adoption

The full recommended budget can be accessed using the Buncombe County Budget Explorer.

Supporting budget documents: