This news item expired on Wednesday, April 15, 2020 so the information below could be outdated or incorrect.

From Buncombe County Libraries:

AARP Foundation Tax-Aide, in cooperation with the I.R.S, N.C. Dept. of Revenue, Buncombe County Library System and Council on Aging, Inc. will again offer free tax Preparations for low and moderate income taxpayers, with special attention to those age 60 and older. Both Federal and N.C. State tax returns will be electronically filed for safe and accurate preparation with faster refunds.

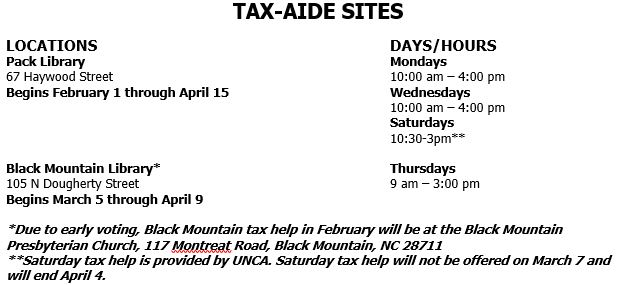

This service will be available from Feb. 1-April 15, at sites listed below. Please note that some locations have different start dates as several libraries will be hosting early voting for the Presidential primaries in February.

Tax help for Weaverville will be held at the Brookstone Baptist Church and tax help for West Asheville will be held at the West Asheville Presbyterian Church. All tax help locations can be found at irs.gov.

Taxpayers should bring the following documents:

- Photo I.D. for taxpayer and spouse

- Social Security cards or equivalent for all taxpayers and dependents

- Copy of last year’s tax return

- Proof of health insurance coverage: Forms 1095 A, B or C; Market Place exemption letter

- Income documents – Forms W-2, SSA-1099, 1099-R, 1099-G, 1099-DIV, 1099-INT, W-2G, other 1099 forms

- Self-employment income – 1099-MISC, and any other income

- Brokerage statements (Form 1099-B), sale of stocks and bonds

- Detailed list and receipts for Medical Expenses, Charitable Contributions, Real Estate Taxes and

- Mortgage Interest (Form 1098), if you are claiming itemized expenses

- Educational expenses (Form 1098-T) and student account statement from College or University

- Bank check for direct deposit of any refund to your checking or savings account